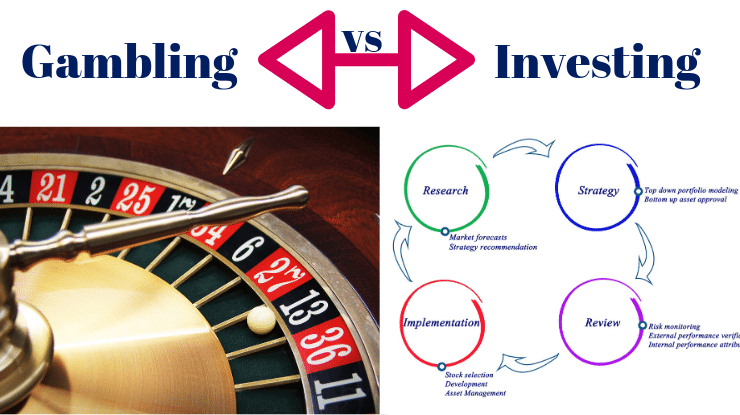

Yes we’re in a pandemic. Yes, investing now may feel very risky. But understanding risk is what makes you wealthy. And so few people actually get it.

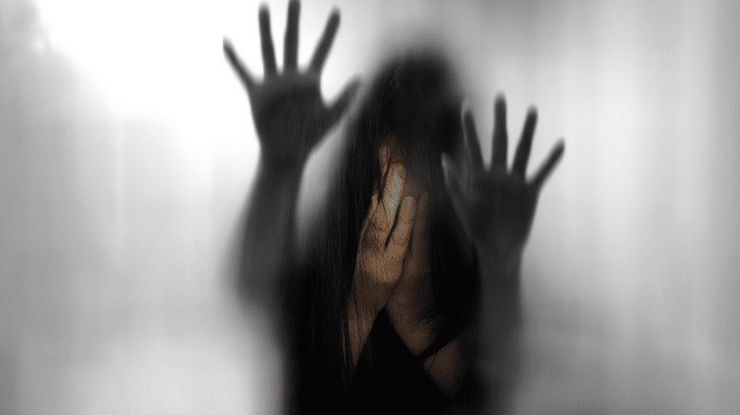

You want to know your most dangerous risk? It’s not the market’s gyrations. It’s your emotional reactions.

The emerging field of neurofinance has proven that most investors, regardless of gender, tend to act on emotions, not rational thinking, when making financial decisions.

The reason? Our brain registers risk even before we’re conscious of it. Consequently we tend to make rash decisions that rarely end well, even if we know better.

So when markets take a tumble, our emotions, especially fear, take over. And we make very bad decisions. It also happens in reverse.