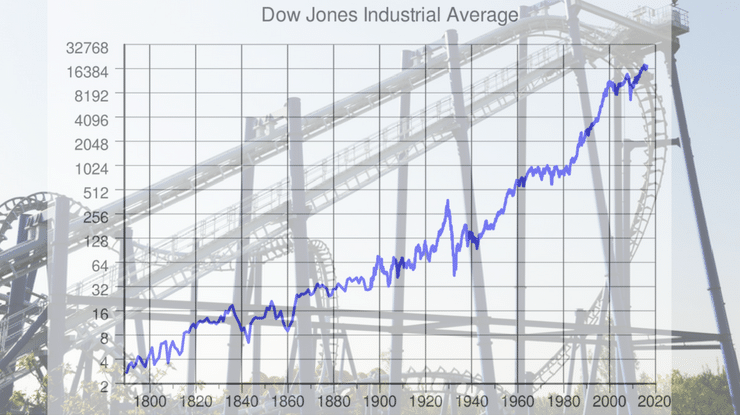

Big news! We’re now in the lengthiest bull market in S&P history. 9 years and counting.

For some, this is cause for celebration. For others, a source of high anxiety. How about you? Amid shaky global politics and stressful market gyrations, are you ready to throw in the towel rather than endure the tension?

I totally get it. My first foray into the market was 1986. A year later—October 19, 1987—the market took a colossal dive. I freaked out, called my broker, told him to sell everything. He begged me not to.

“The market will go up. It always does,” he insisted. “And you’re going to have capital gains tax to pay.”

But I wanted out—NOW! Well, the market recovered, quite quickly. I lost a lot of money. But I learned a priceless lesson. In the 30 years since then, I’ve stayed put despite at least 8 scary crashes. And I’m very happy I did.

Still I know how agonizing market uncertainty is. Before you do anything rash, consider what my favorite Wall Street Journal columnist, Jason Zweig, advises.

While he agrees the best move now is to do nothing, he also has suggestions for easing your anxiety.

“All your actions should be small, gradual and reversible—in case you’re wrong,” he writes. The bigger, more impulsive your moves, the more likely you’ll look back with deep regret. (Like me in 1987)

Here are some things to do to assuage your fears while protecting your future:

- Pay off some or all of your mortgage. “Extinguishing a 4% mortgage, provides you a 4% return at zero risk—a deal you are unlikely to beat anywhere else,” explains Zweig.

- Keep any “windfall,” like a home sale or inheritance, in cash “as a psychological cushion against your fear of a crash.”

- Stop Dollar Cost Averaging, or automatically investing a fixed amount every month. Then when the market crashes and stocks go on sale, it’s buying time again.

- Scale back your stock holdings, say from 70% to 50%. “You could cut back by 5 percentage points every six months or by 1 percentage point each month.”

I urge you to heed Zweig’s wisdom: better to take tiny, thoughtful steps than make hasty moves that may lead to huge mistakes.

I’d love to hear how you’re feeling about the stock market these days? Leave me a comment below.

If you enjoyed this Words of Wealth, click here to receive a copy in your inbox every week.