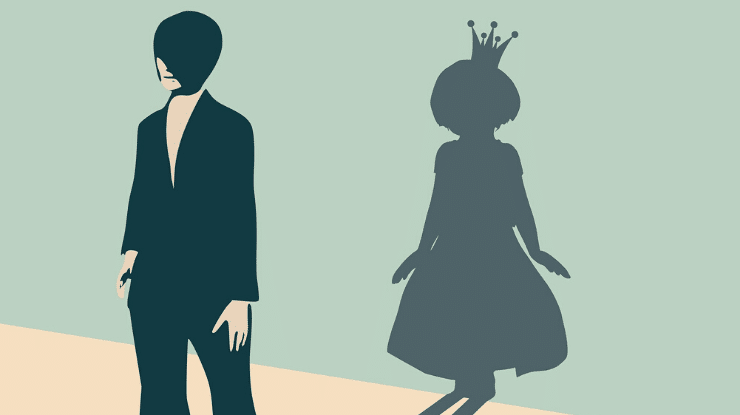

You’re ready. It’s time to open your own business, ask for a promotion or set stronger boundaries. You truly want to take the next step.

But you can’t. Fear, like a colossal boulder, stands in your way.

Of course you’re afraid. Fear is a normal, inevitable, reaction any time you leave the comfort of the familiar and venture into the unknown.

The goal, here, is not to eliminate fear. Because you can’t. The goal is to act in spite of it. I love how writer Ray Bradbury put it.

“Just jump off the cliff and build your wings on the way down,” he said, adding, “If you’re too cautious, you’ll miss life.”

There’s no way around it. If you want success, there’s only one path: feel the fear, endure the discomfort, observe the resistance, and go for it anyway.

But hear this! You don’t have to do it alone. The best antidote to fear, for us women, is surrounding yourself with a supportive community.

As high earner Karen Page once told me: “Success is a social activity. You can’t do it alone. You just can’t.” Amen to that!!

It’s precisely why I created my virtual community—The Wealth Connection—for financially aspiring women.

If you’re looking for a safe, welcoming place to talk openly, intimately, deeply about money, receive personal coaching from me, and encouragement, support & inspiration from the others, you can learn more HERE.

I’d love to hear your thoughts on how a supportive community (of lack of one) has impacted you. Leave me a comment below.