I call it the Secret Shame of Successful Women. And I see it all the time. Bright, sophisticated professionals, making ample incomes, who have little (if anything) to show for it.

Their problem isn’t lack of money. That’s merely a symptom. The real problem is that money is a far more emotional subject than the financial industry recognizes…which does a huge disservice to women.

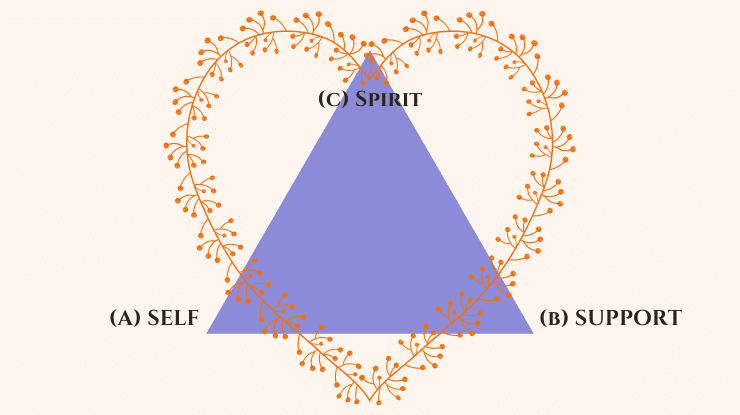

After decades in this business, I’m convinced that the major reason smart, capable women struggle financially is because of Unresolved Emotions. Emotions such as fear, grief, anger and shame, incurred during their lifetime or passed down from earlier generations.