Here’s an interesting exercise. Notice how often you set a goal or express a desire and immediately start finding reasons why it can’t happen.

I see it all the time. A new client walks in, declares her desire—”I really want to make more money,”—and then comes the ”but…”

- I have little kids

- I’m scared

- I never went to college

- I don’t have time

- I’m too old

- I’m too young

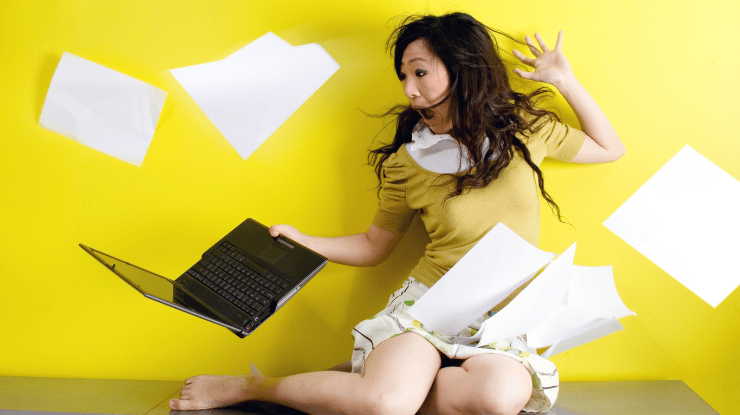

Beware excuses!