The market’s looking pretty scary these days, right? But honestly, it’s not the turbulence that will get you in trouble. It’s your emotional reaction to it.

Studies show that most investors, regardless of gender, tend to act on emotion, instead of rational thinking, when making financial decisions.

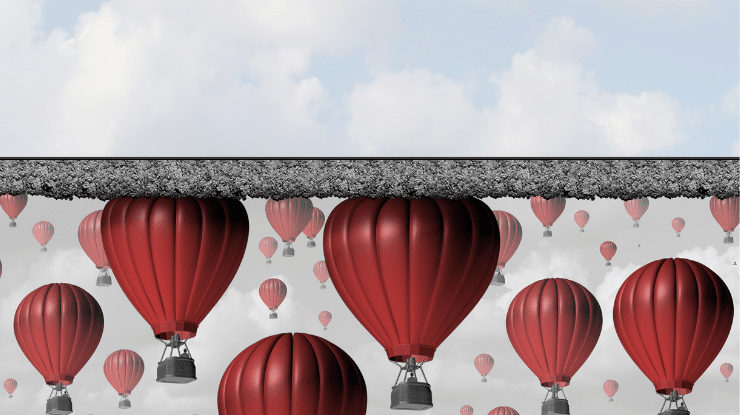

When markets take a tumble, our emotions, especially fear, take over, and we abandon ship, suffering losses.

The emotional reaction also happens in reverse. When the market is on a big run, there’s a tendency to take on too much risk and follow the herd, like so many did during the dot com and real estate booms.

May I suggest another way to view this volatility? Heed the advice of my favorite Wall Street Journal columnist, Jason Zweig: Be thankful that stocks are going down.