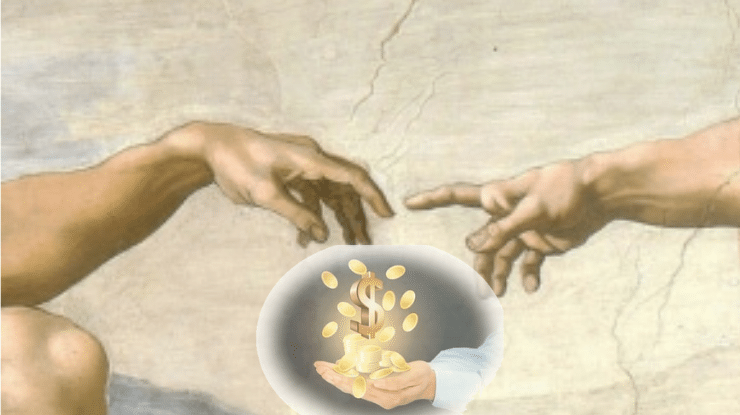

I’ve learned so much from interviewing high earners. Above all, I learned that a Profit Motive is a prerequisite for financial success.

But what propelled those women to higher levels was an added spiritual component, a deep commitment to a Higher Purpose.

While men tend to be motivated largely by profit, perks, and prestige, once we women are financially secure, we shift our focus to how we can serve.

“It happened when my mentality shifted to making a difference,” a successful financial advisor told me of how she went from six figures to seven. “You get to a point where you have more than you need, so you start thinking how you can help others.”