I’ve recently had several thought-provoking conversations centered around three fundamental questions:

- What is Wealth?

- How do you create Wealth (without becoming a workaholic?)

- Why is creating Wealth so scary?

Today, I’d like to share my perspective on these questions. Let’s begin with the first—what is wealth?

Simply put, Wealth is having more than you need…so money ceases to be a source of stress and becomes a tool for living life fully.

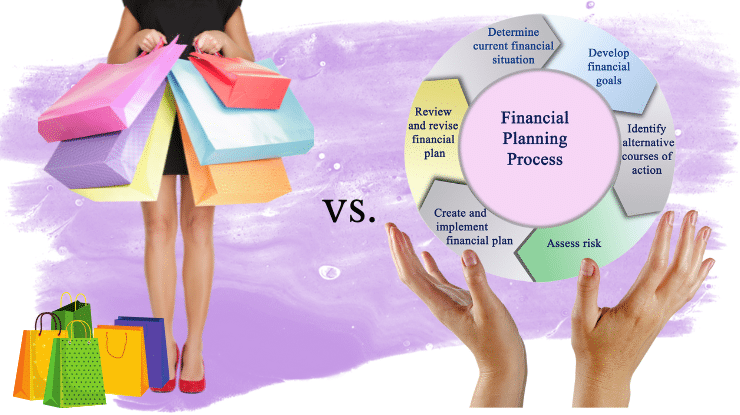

But like any tool, you must understand how to use it skillfully and wisely to get maximum benefit with minimum risk. Which brings us to the 2nd question.