“I really want to make more money,” she said, sighing heavily. “But I find it difficult being comfortable asking for what I’m worth.”

This woman was missing the point. I don’t know anyone who feels comfortable raising their prices or asking for a raise. Yet, underearners will sabotage their success rather than endure the discomfort.

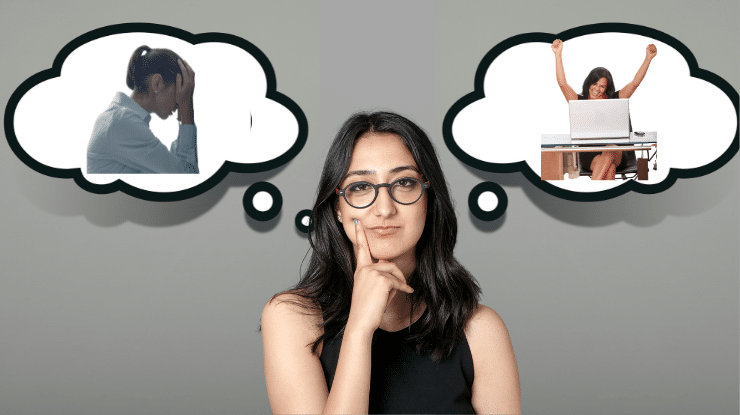

It’s astonishing how fiercely we cling to our so-called Comfort Zones. What a misnomer. These places are anything but comfortable. They’re just familiar and predictable.

Whenever you decide to do something different–whether it’s making more money or losing more weight—you must enter the Discomfort Zone–the space between where you are now and where you want to be.