The ritual begins the morning after Christmas. I wake up wondering about the coming year. As I write, 2021 looms before me like a blank canvas and I ask myself—how do I want to fill it?

Thus begins the Annual Writing of My New Year’s Resolutions. I suspect many of you may be doing the same.

Even if you don’t actually write them down, I imagine you contemplating what you want to achieve in the coming 12 months.

We do it even though we know that New Year’s Resolutions rarely work. In fact, 80% of us give up by the second week in February.

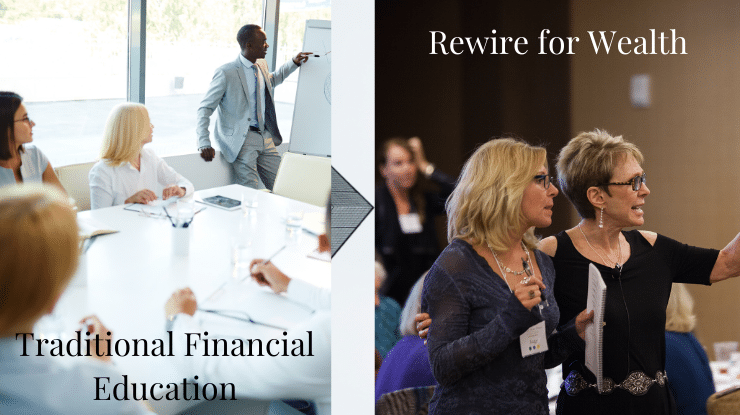

That’s why I’m doing it differently this year. I’ve discovered another way, a better way, to bring those Resolutions into reality. Don’t just Resolve…Rewire!