Sometimes change comes quietly, unexpectedly, when everything lines up perfectly. Tiny miracles, cosmic winks, unmistakable signs that a Higher Power is orchestrating the whole thing. That’s exactly what happened for me last weekend.

It all began at a Seattle Lady Bosses event, an amazing gathering of women entrepreneurs. Seated in small groups, we were asked to briefly introduce ourselves. When my turn came, I said, “I’m Barbara Huson, a Wealth Coach.”

Then something surprising happened. That title didn’t feel right, like a dress that no longer fit.

“Wait!” I said, without a clue what was coming next. “What I really am is a Financial Therapist.”

I’d never used those words before! Yet it felt like a moment of self-revelation, a declaration of a deep-seated truth.

I’ve always called myself a coach. Yet I was trained as a psychotherapist. My true passion is diving in deep with a financially challenged client, tunneling through the darkness to find the light, revealing and removing what’s blocking her from creating the wealth she desires, the life she deserves and the power she’s denied.

I also love talking about investing, creating wealth. But number crunching…not so much. I guess I assumed I had to do it as part of the package.

Meanwhile, sitting next to me is Linda Lingo, a ReWire client, Wealth Connection member, a CPA and financial coach for women. I’d had my eye on Linda for years, impressed with her knowledgeable (and compassionate) responses to financial questions from others on our calls.

And there she was, having just flown in from California. Divine intervention at its finest. The next day, we met. We talked. We got excited. And a few days later, we signed an agreement.

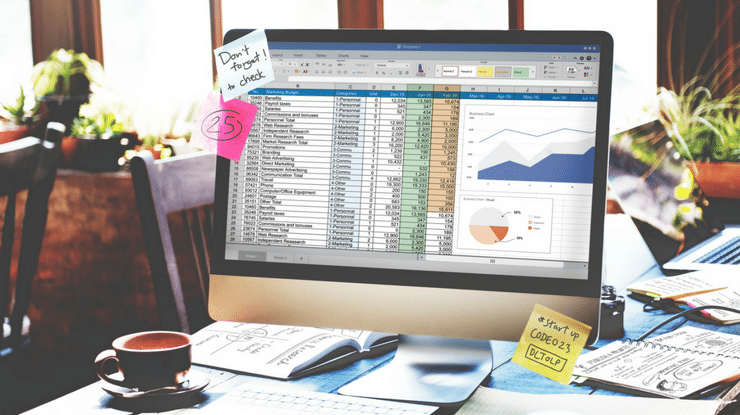

I’m thrilled to announce that the incredible Linda Lingo, CPA, is joining my team as a Financial Planning Coach. She’s ready to help you with budgeting, retirement planning, investment strategy, debt repayment. Click here for the details.

Now I can focus on what I do best: Financial Therapy. Truly a miracle!

Have you experienced any unexpected miracles lately? I’d love to hear about it. Leave me a comment below.

And if you live near Seattle, I urge you to check out Lady Bosses: http://seattleladybosses.com/lady-bosses/

The world needs financially empowered now more than ever. That’s why I’d like you to join me for a FREE call on April 16th. Register now for The ReWIRE Response: Mind Training for Wealth & Well-Being.